Union Savings Bank is a community bank in Connecticut, serving the area since 1866. USB puts their customers first, instead of their shareholders. They work to build lasting relationships that enrich the lives of their customers and the communities they are in. They offer personal and business banking, as well as mortgage, home equity, consumer, and commercial, loans. They also offer wealth management and investment services. USB has 26 total locations across the state of Connecticut.

Union Savings Bank

Company Bio

Overview

- Industry: Banking and Finance

- Location: Danbury, CT

Overview

The Ask

ESM supported Union Savings Bank and their extended agency and marketing team in achieving multiple organizational goals, including increasing account openings for both consumers and businesses, mobile app downloads, new tool integration engagement, and loan financing procurement. The campaign predominantly focused on driving community members and businesses to use Union Savings Bank as their primary banking partner.

The Challenge

With multiple banking options in the greater Connecticut area, USB was competing for a finite number of customers who have many options to choose from as their primary banking partner. An environmental factor that affected USB was two major banks in the competing area merged to form a larger banking system. USB was now in the market with larger competition.

Why it Worked

The Approach

Our approach was to saturate the areas of Connecticut where Union Savings Bank branches are located and use digital, traditional, and experiential activations to drive results. This included paid social media posts, programmatic display and video ads targeted within relevant top sites and context related to banking and financing, terrestrial radio across local Connecticut stations, and Pop-Up Shops at community events and other high traffic areas.

The Solution

By using persona information to help segment audiences, we were able to reach and track users across different life stages, group affiliations, or economic status to create a refined, key audience. We tracked them to see responses to USB’s messaging, and ultimately if they converted as a new customer within the scope of our campaign.

Results

Campaign Results

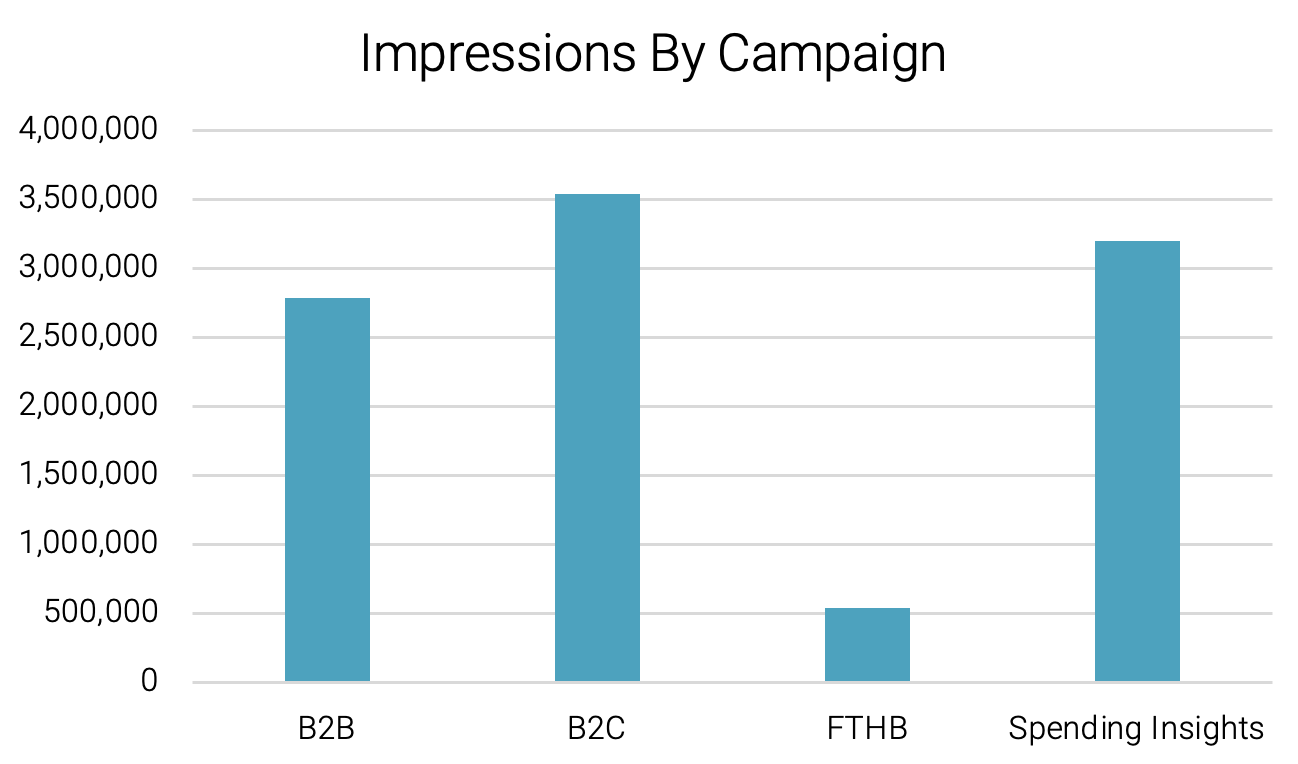

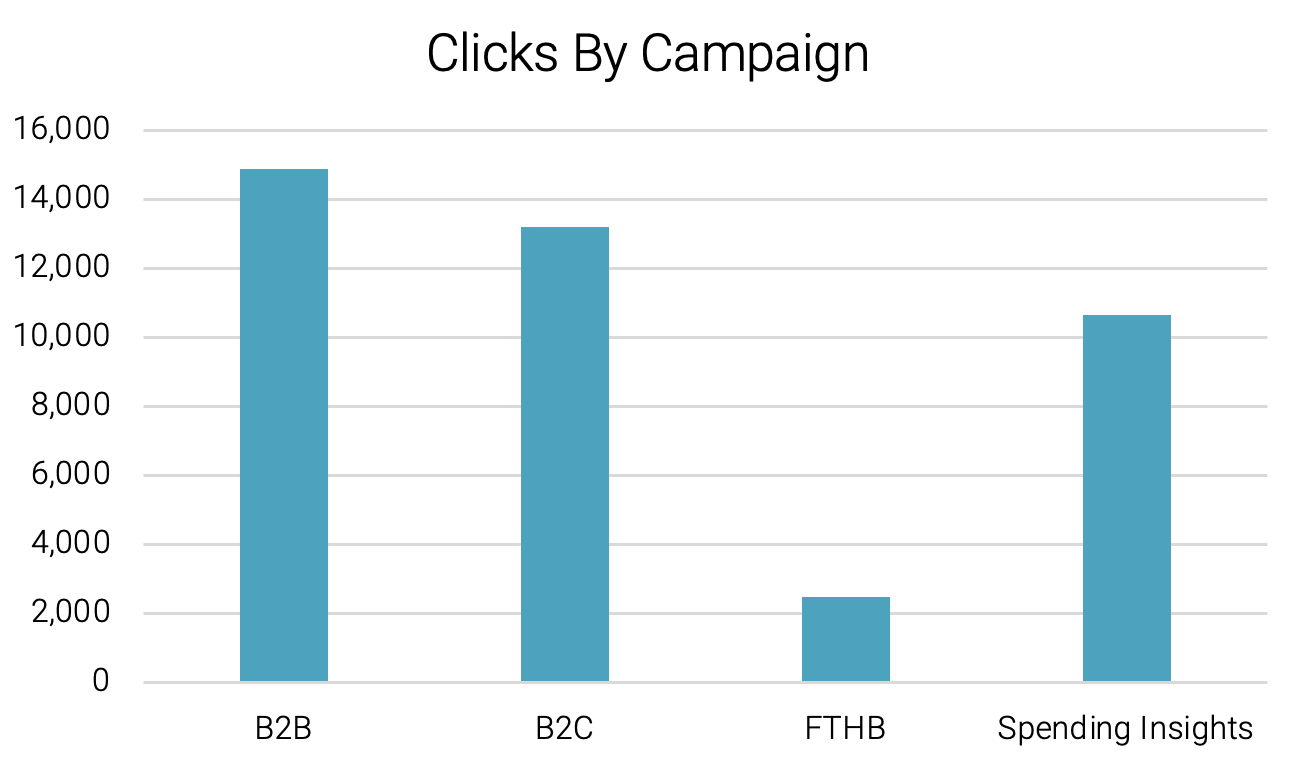

We were able to effectively open 829 new personal and business banking accounts through our community based targeting. Business checking accounts saw an 8% year-over-year increase, while cost per acquisition for personal banking accounts was below industry average. Over $18 million in total loan acquisition was directly attributed to our campaign. We generated 228 new app downloads driven by our promotion of their new tools and offerings. The success of our campaign resulted in growth for USB’s specific goals, and overall awareness as they generated over 10 million impressions in their key markets of focus.

829

62

228